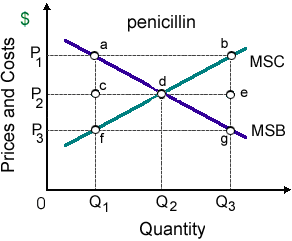

When governments compelled pharmaceutical producers to manufacture and sell at least Q3 penicillin, in that case the: (1) purely-competitive firms which produced penicillin would experience persistent economic profits. (2) resulting inadequate antibiotic treatments would leave much disease untreated. (3) marginal social benefits of penicillin would exceed the marginal social costs. (4) loss in social welfare would about equal the area of triangle adf. (5) marginal social costs of penicillin would exceed the marginal social benefits.

Hey friends please give your opinion for the problem of Economics that is given above.