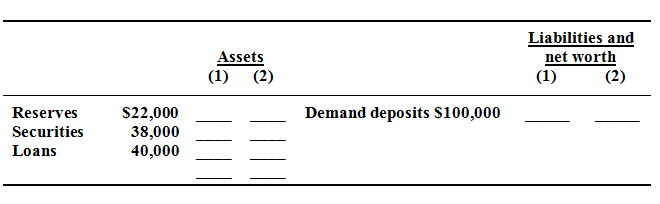

Balance sheet of Yukon Bank is given below. if reserve ratio is 10 percent. Estimate the maximum amount of new loans which bank can make? Demonstrates in column 1 how the bank's balance sheet will look after the bank has loaned this extra amount. Determine by how much has the supply of money altered? . How will the bank's balance sheet illustrates after cheques drawn for the overall amount of the new loans have been vacant against this bank? Make out this new balance sheet in column 2.