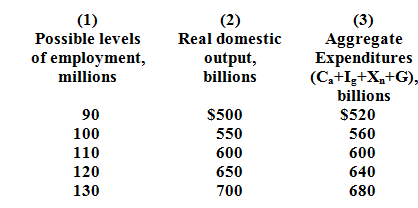

Refer to the table below in answering the questions which follow:

In this economy if full employment is 130 million, will there be an inflationary expenditure gap or recessionary expenditure gap? Describe the consequence of this gap? By how much would aggregate expenditures in column 3 ought to change at each level of GDP to remove the inflationary expenditure gap or recessionary expenditure gap? Illustrates. Describe multiplier in this example?