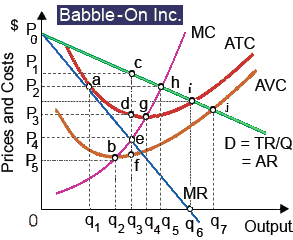

Babble-On maintains world-wide patents for software which translates any of 314 spoken languages within text, along with automatic audio and text translations within any of the other three-hundred-thirteen languages. When Babble-On is a pure monopoly, such firm confronts a demand curve which is: (w) identical to the industry demand curve. (x) perfectly price inelastic. (y) unitarily price elastic. (z) perfectly price elastic.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.