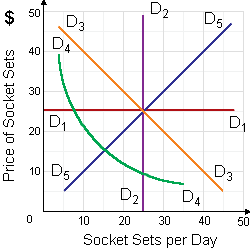

The curve which is so inconsistent along with standard consumer theory which is based only on the substitution result, this could not possibly be a demand curve for any standard kind of consumer good is: (1) curve D1D1. (2) curve D2D2. (3) curve D3D3. (4) curve D4D4. (5) curve D5D5.

Please choose the right answer from above...I want your suggestion for the same.