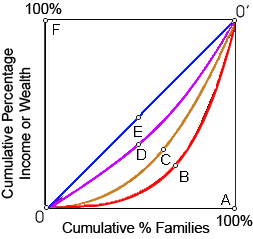

When line 0C0' in this figure shows the current Lorenz curve for the U.S. distribution of income after taxes and transfers, the probably short run outcomes of 10 percent cuts into both income tax rates and government transfer payments would be which the: (1) country's distribution of income would be unaffected. (2) country's after-tax and transfer Lorenz curve could shift to line 0B0'. (3) cuts could move the Lorenz curve towards the line 0E0'of perfect equality. (4) country's after-tax and transfer Lorenz curve could shift to line 0D0'. (5) Lorenz curve would shift away by line OF0', the line of perfect inequity.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.