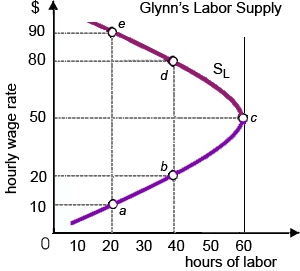

The income effect of a small change within wage rate is approximately identical to the substitution consequence for Glynn at: (i) point a. (ii) point b. (ii) point c. (iv) point d. (v) point e.

How can I solve my Economics problem? Please suggest me the correct answer.