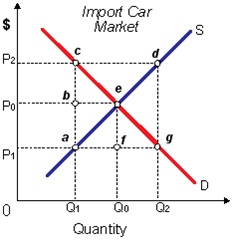

When the import car market is in equilibrium prior to the government limits car imports to Q1, the price that buyers will reimburse for an import: (1) Drops/falls from P0 to P1. (2) Is stable, although dealer gains fall by Q0 to Q1. (3) Increases from P0 to P2. (4) Exhibits a subsidy wedge of P2 to P1.

Can someone help me in getting through this problem.