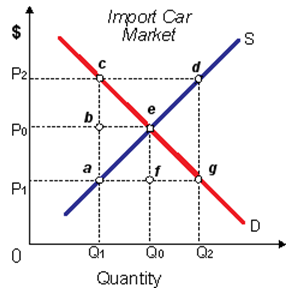

While the import car market is in equilibrium before the government restricts car imports to Q1, the price which buyers will pay for an import as: (1) falls from P0 to P1. (2) is stable, although dealer profits fall by Q0 to Q1. (3) rises from P0 to P2. (4) shows a subsidy wedge of P2 to P1.

Hello guys I want your advice. Please recommend some views for above economics problems.