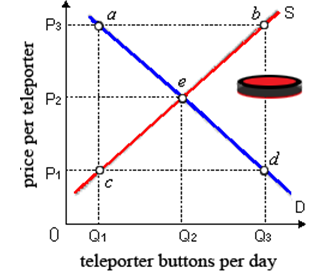

The teleporter market would show a surplus when: (1) teleporter buttons were priced at P3. (2) Q2 teleporter buttons were produced and sold at a price of P2. (3) teleporter buttons were priced at P2. (4) Q3 teleporter buttons were produced and sold at a price of P3. (5) teleporter buttons were priced at P1.

How can I solve my economics problem? Please suggest me the correct answer.