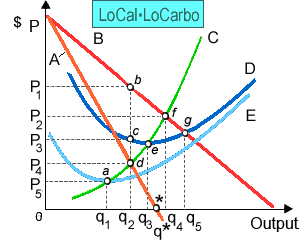

LoCalLoCarbo has become the favorite of fad dieters. There in curve E shows: (1) LoCalLoCarbo’s marginal cost curve. (2) LoCalLoCarbo’s average variable cost curve. (3) LoCalLoCarbo’s average total cost curve. (4) the market demand curve facing LoCalLoCarbo. (5) LoCalLoCarbo’s marginal revenue curve.

Hello guys I want your advice. Please recommend some views for above Economics problems.