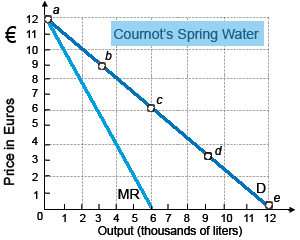

Monsieur Cournot contains a monopoly on an artesian well from that flows tasty spring water reputed to have medicinal properties. To ignore incurring any variable costs, he is adamants that customers bring their own pails also fill them personally. Regrettably, Cournot cannot price discriminate since his customers all deal along with each other regularly. Cournot’s greatest strategy for maximizing profit is to: (w) maximize total revenue by selling the quantity of water where demand is unitarily price elastic. (x) sell 9,000 liters per period at a price of 3 Euros per liter. (y) charge each customer the most they are willing to pay for any water. (z) sell 3,000 liters per period at a price of 9 Euros per liter.

How can I solve my Economics problem? Please suggest me the correct answer.