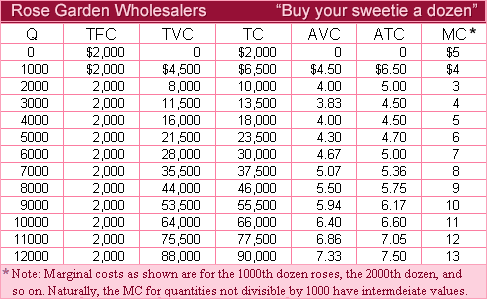

When Rose Garden Wholesalers has a typical type cost structure of rose farms within this purely competitive industry, into the long run new competitors would most likely enter the market providing the wholesale price per dozen roses exceeded as: (i) $3.00 per dozen roses. (ii) $3.83 per dozen roses. (iii) $4.00 per dozen roses. (iv) $4.30 per dozen roses. (v) $4.50 per dozen roses.

Hey friends please give your opinion for the problem of Economics that is given above.