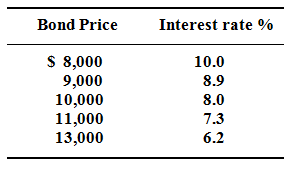

Assume a bond along with no expiration date has a face value of $10,000 & annually pays a fixed amount on interest of $800. Calculate and enter into the spaces provided either the interest rate that the bond would yield to bond buyer at each of the bond prices tabulated or the bond price at each of the interest yields illustrated. What generalization can be drawn through the concluded table?