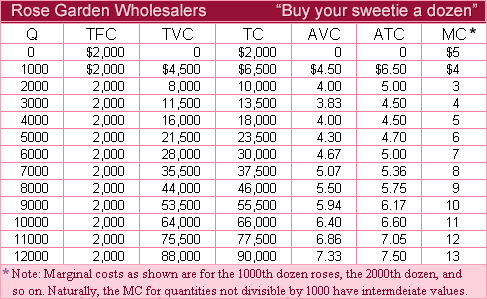

This purely competitive rose farm would most likely exit in this industry with the long run when the wholesale price per dozen roses fell below: (i) $4.50 per dozen roses. (ii) $5.00 per dozen roses. (iii) $5.50 per dozen roses. (iv) $6.00 per dozen roses. (v) $6.50 per dozen roses.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.