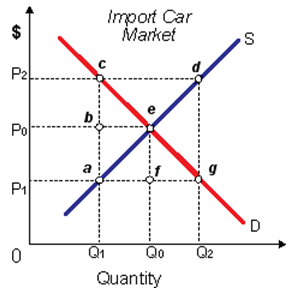

Imports and American cars are close nevertheless not ideal substitutes. When the U.S. government tried to boost American car sales through setting a price ceiling of P1 upon imported cars in that case: (w) the quantity of cars imported will fall from Q0 to Q1. (x) American car prices would rise to P2. (y) foreign car exporters would ship more luxury cars to the United States. (z) American-made car sales would rise by Q2 to Q0.

Hello guys I want your advice. Please recommend some views for above economics problems.