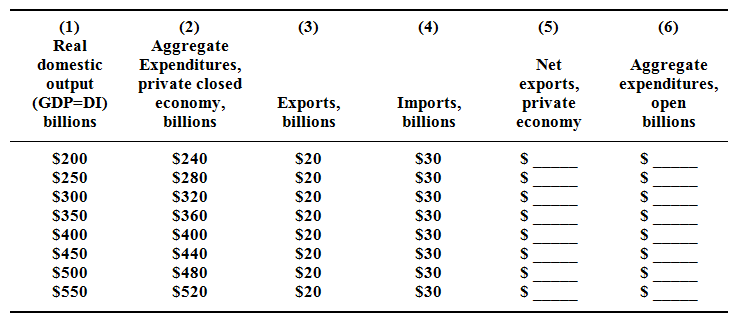

The data of columns 1 and 2 of the given table are for private closed economy. Open up this economy to international trade through including the export & import figures of columns 3 and 4. Fill up in columns 5 and 6 to find out the equilibrium GDP for the open economy. Describe why this equilibrium GDP varies from that of the closed economy.