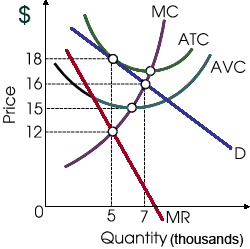

This graph depicts a short run situation while long run equilibrium has been achieved for a firm along with some market (price-making) power when the firm cannot price discriminate and: (w) has explicit costs but no implicit costs. (x) operates in an industry in that competitors can easily enter or exit the market in the long run. (y) is closely regulated by government to ensure which this does not price discriminate. (z) maintains a constant level of market power because of substantial barriers to entry within the market.

I need a good answer on the topic of Economics problems. Please give me your suggestion for the same by using above options.