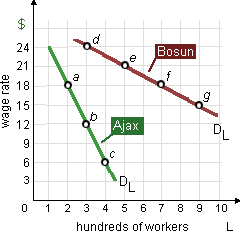

The dissimilarities in the arc elasticities of demands for labor among the Ajax Corporation and Bosun Limited are consistent along with an inference which Bosun: (1) is a more profitable firm than Ajax. (2) hires more highly skilled workers than Ajax does. (3) will grow quicker than the Ajax Corporation. (4) can most likely substitute capital for labor more productively than Ajax can. (5) produces output which sells for a higher price than Ajax’s product.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?