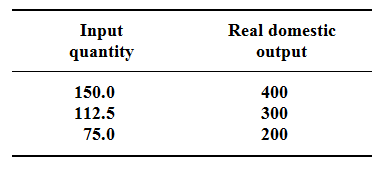

Assume that the hypothetical economy had the given relationship among its real domestic output and the input quantities essential for producing that level of output:

Suppose that the input price rise from $2 to $3 along with no accompanying change in productivity. Determine the new per unit cost of production? In what direction did the $1 rise in input price push the aggregate supply curve? Determine effect of this shift in aggregate supply upon the price level and the level of real output?