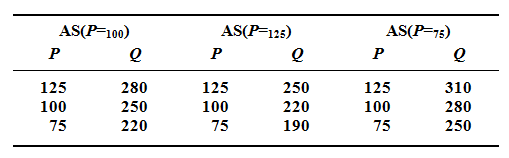

Assume the full employment level of real output (Q) for a hypothetical economy will be $250 and the price level (P) at first is 100. Employ the short-run aggregate supply schedules below to answer the questions that follow:

Determine the level of real output in the short run if the price level unexpectedly increase from 100 to 125 due to an increase in aggregate demand? What if the price level drops unexpectedly from 100 to 75 due to a decrease in aggregate demand? Describe each circumstance, using numbers from the table.