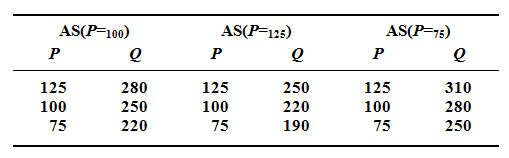

Consider the full employment level of real output (Q) for a hypothetical economy will be $250 and the price level (P) at first is 100. Employ the short-run aggregate supply schedules below to answer the questions that follow:

Determine the level of real output in the long run while the price level increase from 100 to 125? While it falls from 100 to 75? Depict each situation.