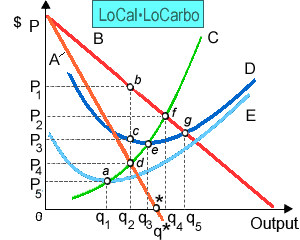

LoCalLoCarbo that is Favorite Corporation of fad dieters, which can maximize its total revenue when this produces: (1) output q2 and charges a price equal to P1. (2) output q3 and charges a price of more than P2 although less than P1. (3) output q* and charges a price of more than P2 but less than P1. (4) output q4 and charges a price equal to P2. (5) output q5 and charges a price of more than P3 although less than P2.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?