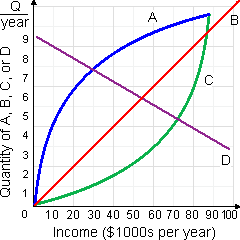

As in below figure demonstrates how consumption of goods A, B, C, and D varies like a family’s income changes. Of such goods, the only inferior good: (w) good A. (x) good B (y) good C. (z) good D.

I need a good answer on the topic of Economic problems. Please give me your suggestion for the same by using above options.