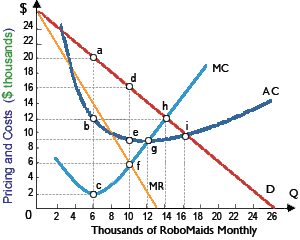

When Robomatic Corporation maximizes profit in its production of RoboMaids, its average production cost per robot will be roughly: (1) $3,000 per robot. (2) $5,000 per robot. (3) $7,000 per robot. (4) $9,000 per robot. (5) $11,000 per robot.

Hello guys I want your advice. Please recommend some views for above Economics problems.