Describe the Hirfindahl-Hirschman Index?

The Hirfindahl-Hirschman Index, or HHI, is the standard measure employed by economists to evaluate market concentration. The greater the level of concentration amongst competitors, the higher the HHI. The HHI runs on a scale from zero (representing extreme competitiveness) to 10,000 (demonstrating monopoly). The HHI is determined by squaring (multiplying by itself) the market share of every firm in a market, and then adding up the results.

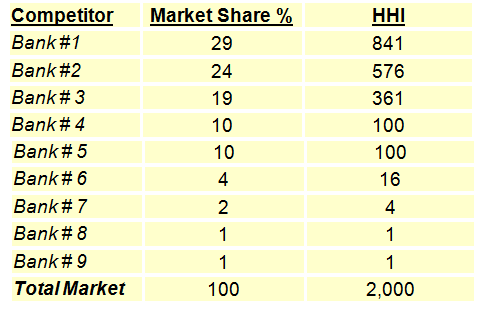

Example Calculation for a Hypothetical Market With HHI of 2,000

(Hirfindahl-Hirschman Index Source: Federal Reserve)