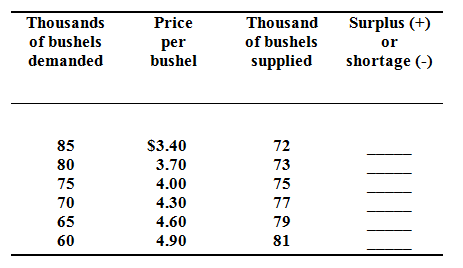

Assume the total demand for wheat and the net supply of wheat per month in the Kansas City grain market are as:

Describe the equilibrium price? Explain the equilibrium quantity? Fill in the surplus-shortage column and employ it to depict why your answers are correct.