Assume you are planning to make regular contributions in equivalent payments to an investment fund for your retirement. Which formula would you employ to figure out how much your investments will be worth at retirement time, specified an assumed rate of return on your investments?

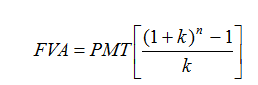

To figure out how several your investments will be worth at retirement time, specified an assumed rate of return on your investments, you would employ the future value of an annuity formula:

Future Value of an Annuity Formula

Here: FVA = Future Value of an Annuity

PMT = Amount of each annuity payment

k = Interest rate per time period

n = Number of annuity payments