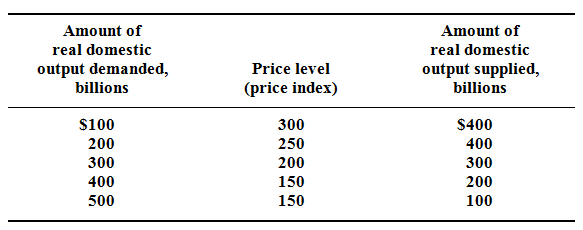

Assume that aggregate demand and the short run supply for a hypothetical economy are as illustrated below:

Assume that buyers wish to purchase $200 billion of extra real domestic output at each price level. Describe factors might cause this change in aggregate demand? Describe the new equilibrium price level and level of real output?