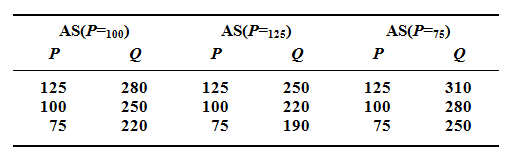

For a hypothetical economy, suppose the full employment level of real output (Q) will be $250 and the price level (P) firstly is 100. Employ the short-run aggregate supply schedules below to answer the questions that follow:

Demonstrate the circumstances explained in parts a and b on graph paper, and derive the long-run aggregate supply curve.