Define Break Even point? Elucidate with the help of saving function.

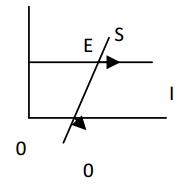

Answer: Breakeven point is a point where consumption equals to income and saving is equivalent to zero.

At point E saving is equivalent to zero; therefore point E is termed as Break Even point. To the left of point saving is negative, and to the right of E saving is positive.