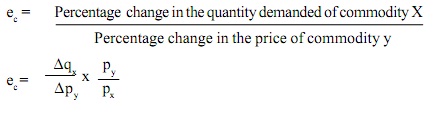

Cross-elasticity of demand:

The receptiveness of demand to modifications in prices of associated goods is termed as cross-elasticity of demand (i.e., associated goods might be substitutes or complementary goods). In another words, it is the receptiveness of demand for commodity x to the modification in the price of commodity y.

The relationship among x and y commodities might be substitutive as in the situation of tea and coffee or complementary as in the situation of ink and pen.