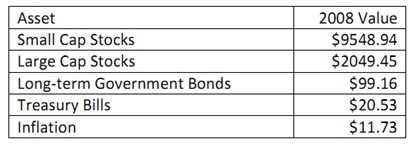

Solve for the stated annual rate, r equal to the continuously compounded rate of return implicit in turning $1 at the end of 1925 (beginning of 1926) into these reported valued from RWJ9 in 2008 Figure below:

1. Determine the stated continuously compounded rate of return on small cap stocks?

2. Find out the stated continuously compounded rate of return on large cap stocks?

3. Find out the stated continuously compounded rate of return on Long-term Government Bonds?

4. Find out the stated continuously compounded rate of return on Treasury bills?

5. Evaluate the stated continuously compounded rate of return on Inflation

6. Describe the risk premium on large cap stocks relative to “riskless” Treasury bills?

7. Briefly explain, how did Treasury bills perform relative to inflation?

8. Draw a general conclusion from your computations