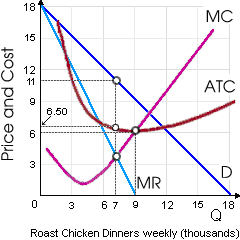

When consumers ultimately cannot distinguish one roasted chicken dinner from other, when roasted chicken dinners are produced within a constant cost industry, and when no barriers to entry or exit exist, in that case the long-run equilibrium price per generic chicken dinner will be approximately: (1) $12. (2) $10. (3) $8. (4) $6. (5) $3.

How can I solve my Economics problem? Please suggest me the correct answer.