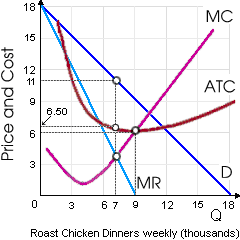

When consumers eventually cannot distinguish one roasted chicken dinner from other, while roasted chicken dinners are produced into a constant cost industry, and when no barriers to entry or exit exist, so this firm’s long-run economic profit will be about: (1) $29,000 per week. (2) $31,500 per week. (3) $34,000 per week. (4) $36,500 per week. (5) zero per period.

Please choose the right answer from above...I want your suggestion for the same.