Please do the following and submit your results in the table format in a word file on canvas:

a) Go to Yahoo finance/Investing/Stocks/Research tools/Historical quotes/Historical prices and download adjusted monthly closing prices for the period 1/1/2006 to 31/12/2012 for:

Exxon (XOM)

Walmart (WMT)

S&P 500 (^GSPC)

b) Sort data from oldest to newest record.

Compute monthly returns for each stock and index:

Return at time t = (Pt-Pt-1)/Pt-1

c) Compute the following statistics for each stock and the index:

i. Average monthly return

ii. Geometric monthly return and the corresponding annual return.

iii. The monthly standard deviation and corresponding annual standard deviation

iv. Use the monthly returns and compute the correlation between each pair (Exxon-Walmart, Exxon-S&P 500, Walmart-S&P 500).

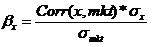

v. What is the beta for each stock? The beta for stock x is given by the following formula,

Please present your results in the following format:

|

Statistic

|

Exxon

|

Walmart

|

S&P 500 Index (mkt)

|

|

Average monthly return

|

|

|

|

|

Compounded monthly return

|

|

|

|

|

Annual return

|

|

|

|

|

Monthly standard deviation

|

|

|

|

|

Annual standard deviation

|

|

|

|

|

Correlation

|

|

|

|

|

Exxon-Walmart =

|

|

|

|

|

Exxon-S&P 500 =

|

|

|

|

|

Walmart-S&P 500 =

|

|

|

|

|

Beta

|

|

|

|