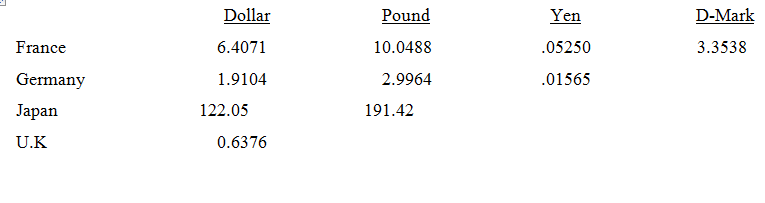

Calculate a cross-rate matrix for the French franc, Japanese yen, German mark, and the British pound. Use the most current European term quotes to compute the cross-rates so that the triangular matrix result is alike to the portion above the diagonal .

The cross-rate formula we desire to use is:

S(k/j) = S(k/$)/S(j/$).

The triangular matrix will hold 4 x (4 + 1)/2 = 10 elements.