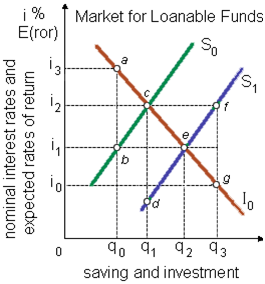

The first plans of savers and investors within this closed private economy are demonstrated as S0 and I0. Assume that people begin spending less on current consumption, and total saving plans shift to curve S1. By a classical adjustment is for the: (w) interest rate to fall to i2 when both saving and investment increase to q1. (x) future spending by consumers to perfectly offset the decline into current consumption; it provides firms along with sufficient incentives to store all their inventories. (y) investment curve I0 to shift rightwards due to the higher profits expected from future sales of the extra goods produced through the extra capital accumulated. (z) fall in interest rates to shift households back towards more current consumption.

Please help me to solve the problem of Economic that is given above.