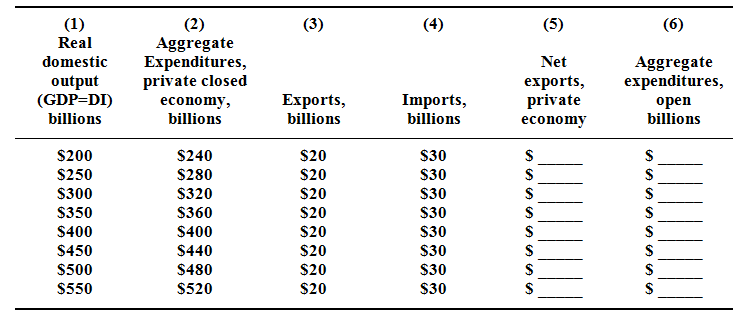

Refer to columns 1 and columns 6 of the tabular data described below. Suppose that all taxes are personal taxes and that government spending does not induce a shift in the private aggregate expenditures schedule. Calculate and describe the changes in equilibrium GDP caused by the addition of government.