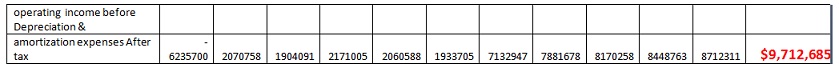

Calculation of NPV: Calculation of NPV is done through the same method of discounting as described above. However in this case the rate is predefined for discounting. It is the cost of overall long term resources, whether debt or equity. This cost is also known as weighted average cost of capital. In this case the cost is given as 17.5 % WACC. The cash inflows of various years have discounted using excel function to arrive at the value of $9,712,685