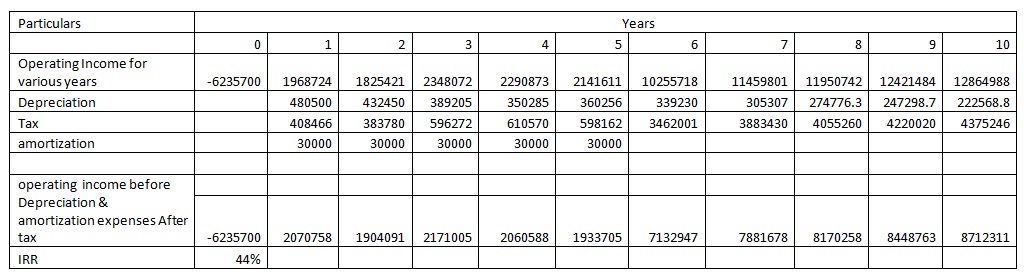

Calculation Of IRR: IRR is the rate at which your discounted cash inflow becomes equal to your discounted cash outflow. In other words NPV=0. To determine this following steps are followed:-

1. Determine cash inflow. This is equivalent to operating income after tax although before depreciation & amortization expenses.

2. Determine project investment in the beginning of the project life.

3. Select a discount rate which will discount cash inflow to reduce it .discounting is done in following method:

= Amount*(100/100+rate)N.

Here n is number of year of the amount being considered.

4. Incase discounted value is higher than the project cost than select a higher rate of discounting & if it is lower than select a lower discounting rate for the cash inflows of all periods

5. The IRR in the assignment is calculated through this method