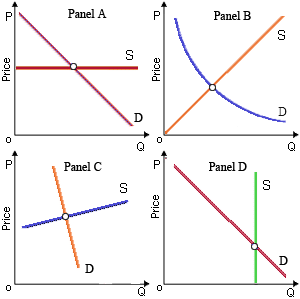

Most of the burden of an excise (i.e., per unit) tax would be borne through consumers of the taxed good, although some of the tax burden would reduce on suppliers of the good demonstrated in: (w) Panel A. (x) Panel B. (y) Panel C. (z) Panel D.

Can someone explain/help me with best solution about problem of Economics...