Question:

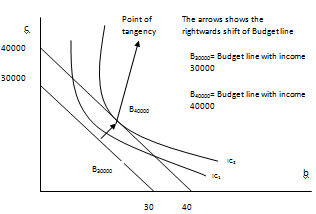

Monica has been considering buying a mountain bike. Last month Monica had an income of $30,000. The bike's price was $1000, the composite good price was $1, and she decided not to buy the bike. This month Monica was surprised to get a $10,000 increase in income. The prices of the bike and the composite good are the same, but now Monica decides to buy the bike. Draw a budget line and indifference curves to illustrate this situation. Be sure to label you diagram completely.

Solution:

Income, m = $30,000, Pb = $1000, Pc = $1

Where, Pb = price of bike.

Pc = price of composite goods

Therefore, Budget equation is:

c + Pb b = 30000

- c = 30000 - Pb b

- c = 30000 - 1000b

Therefore, putting c on vertical axis, the slope is -1000

Also, vertical intercept = 30000/1 = 30000

Horizontal intercept = 30000/1000 = 30

The new income = $40,000

Therefore, Budget equation is:

c + Pb b = 40000

- c = 40000 - Pb b

- c = 40000 - 1000b

Therefore, putting c on vertical axis, the slope is -1000

Also, vertical intercept = 40000/1 = 40000

Horizontal intercept = 40000/1000 = 40