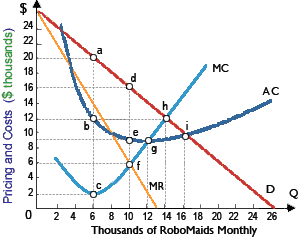

Robomatic Corporation would exactly break-even upon its RoboMaids when, instead of exactly identifying its profit-maximizing strategy, this: (i) operated at point i, charging only $10,000 per unit and producing 16,000 robots. (ii) priced each robot at $24,000 but sold only 1,800 robots each month. (iii) charged $16,000 per robot and sold 10,000 robots per month. (iv) produced 6,500 robots per month as well as sold them for $18,000 apiece.

Hello guys I want your advice. Please recommend some views for above Economics problems.