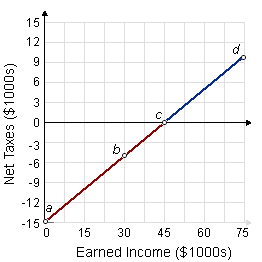

The break-even level of income for four member of family under the negative income tax system demonstrated in this figure is: (1) $15,000 per year. (2) $30,000 per year. (3) $45,000 per year. (4) $60,000 per year. (5) $75,000 per year.

Hey friends please give your opinion for the problem of Economics that is given above.