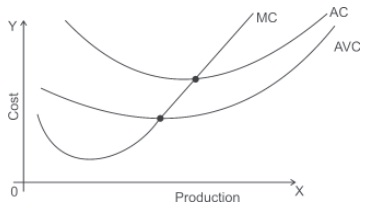

Relation between Average cost, aversge variable cost and Marginal cost:

A) MC interects to AC and AVC at their minimum level

B) AC and AVC decreases before the interection by MC, but remain greater than MC.

C) AC and AVC starts to increase after the itersection by MC, and becomes less than MC.

D) As output increases, AC and AVC tends to be closer but the difference between AC and AVC can naver be zero.