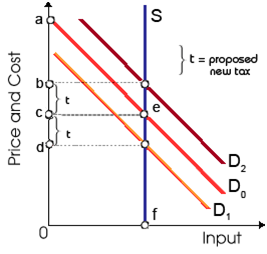

Assume that D0 is the initial demand curve for land in this demonstrated figure, and a land tax at a rate of t is imposed. Trying by the landlord to pass the tax forward to the renter, which will cause the: (i) supply curve of housing to shift rightward. (ii) supply curve of land to shift leftward. (iii) demand curve to shift upward to D2, by the amount of the tax. (iv) demand curve by tenants facing the landowner to shift downward to D1, from the amount of the tax. (v) landowners’ profit to rise.

Hello guys I want your advice. Please recommend some views for above Economics problems.