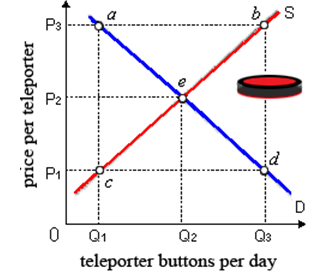

Participants in this market would experience a surplus in this market for teleporter buttons: (1) at all possible price per button exceeding P2. (2) equal to distance cd when the price per button equals P1. (3) when this market was primarily in equilibrium, and in that case the government imposed a tax equal to P2-P1 on teleporter button production. (4) at every price where demand exceeds the supply of teleporter buttons (1) eliminating the shortage Q1-Q3 existing at P3. (5) when teleporter button manufacturers began exporting the buttons to China.

Please choose the right answer from above...I want your suggestion for the same.