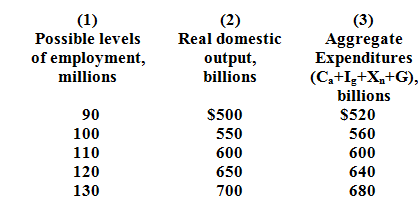

Refer to the table below in answering the questions which follow:

Will there be recessionary expenditure gap or inflationary expenditure gap if the full-employment level of output is $500 billion? Describe the consequences. By how much aggregate expenditure in column 3 ought to change at each level of GDP to remove the gap? Explain. Illustrates the multiplier in this example?