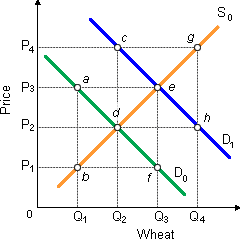

Assume that the U.S. wheat market is firstly into equilibrium on S0D0. Now assume the government institutes a legal price floor at P3 per bushel of wheat. When the government does nothing else, one outcome will be such: (w) American dieters will determine it less costly to stay on a low carbohydrate diet. (x) farmers' annual total revenues (price × quantity) will change from 0P2dQ2 to 0P3aQ1. (y) yearly shortages of wheat equal to distance bf will be created (z) total revenue yearly for farmers will fall from 0P4gQ4 to 0P3eQ3.

I need a good answer on the topic of Economic problems. Please give me your suggestion for the same by using above options.